The Only Guide to Insurance Advisor

Wiki Article

Get This Report on Insurance Asia Awards

Table of ContentsExcitement About Insurance AgentRumored Buzz on Insurance MeaningThe Basic Principles Of Insurance Quotes The Best Strategy To Use For InsuranceAn Unbiased View of Insurance Asia AwardsThe Only Guide for Insurance Ads

Impairment insurance can cover long-term, momentary, partial, or overall special needs. It does not cover medical treatment and services for long-term treatment.

Life Insurance Policy for Children: Life insurance policy exists to replace lost revenue. Children have no earnings. Accidental Death Insurance Policy: Also the accident-prone should skip this kind of insurance coverage. It typically includes a lot of constraints, that it's virtually difficult to accumulate (insurance meaning). Disease Insurance: A health insurance coverage is possibly a far better investment than trying to cover on your own for every single sort of disorder that's available.

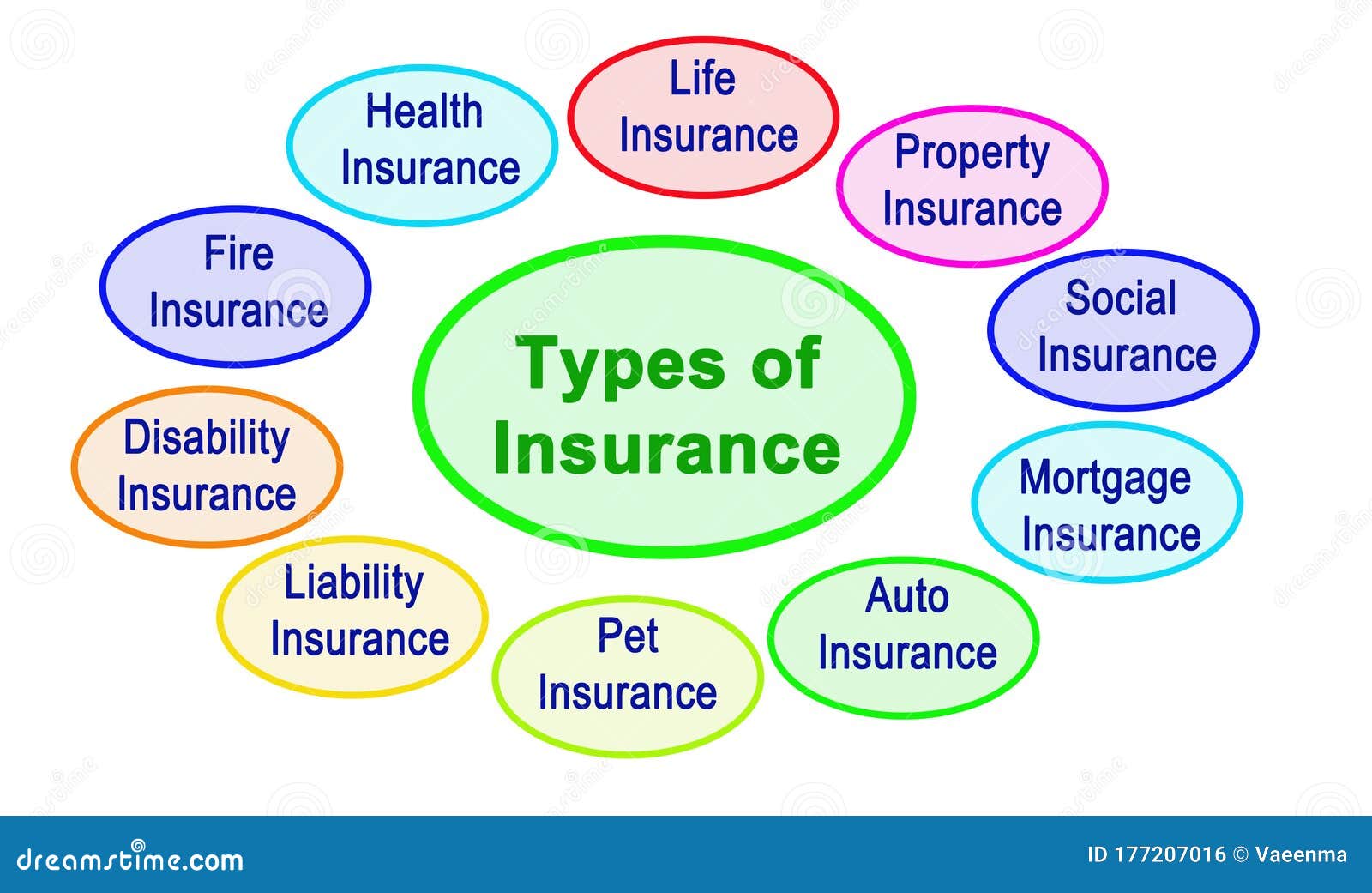

It's finest to take a stance someplace in between these 2 way of thinkings. You must absolutely think about getting all or most of the 5 required kinds of insurance policy discussed over. These are the most important insurance kinds that offer substantial financial relief for very reasonable situations. Beyond the 5 primary sorts of insurance, you ought to think very carefully prior to getting any added insurance.

4 Easy Facts About Insurance Account Described

Keep in mind, insurance coverage is meant to secure you and also your funds, not injure them. If you require assistance with budgeting, try making use of a costs payment tracker which can aid you keep all of your insurance coverage settlements so you'll have a better grip on your individual financial resources. Related From budgets and also expenses to cost-free credit rating rating and also more, you'lldiscover the effortless means to stay on top of everything.There are many insurance choices, and also many economic experts will state you need to have them all. It can be hard to establish what insurance you really need.

Factors such as children, age, lifestyle, and employment advantages contribute when you're constructing your insurance portfolio (insurance commission). There are, nonetheless, four kinds of insurance policy that many financial experts recommend we all have: life, health, auto, and also long-term impairment. 4 Types Of Insurance Everyone Demands Life insurance policy The biggest benefits of life insurance policy consist of the capability to cover your funeral service expenditures and also offer those you leave behind.

Getting The Insurance Agent To Work

The two fundamental types of life insurance policy are conventional entire life and also term life. Simply discussed, entire life can be utilized as an earnings device as well as an insurance instrument. As long as you remain to pay the regular monthly premiums, entire life covers you until you die. Term life, on the other hand, is a policy that covers you for a set amount of time.

Usually, also those workers who have excellent health insurance coverage, a good savings, and also an excellent life insurance coverage plan don't prepare for the day when they may not have the ability to function for weeks, months, or ever before once more. While health insurance policy spends for a hospital stay and also medical costs, you're still entrusted those day-to-day expenditures that your income generally covers.

All about Insurance Meaning

Lots of employers offer both short- and also long-term disability insurance policy as part of their benefits plan. A policy that ensures income substitute is ideal.7 million auto crashes in the united state in 2018, according to the National Highway Web Traffic Safety Management. An estimated 38,800 individuals died in car accidents in 2019 alone. The primary cause of death for Americans in between the ages of five as well as 24 was car accidents, according to 2018 CDC information.

The 2010 financial costs of car mishaps, consisting of fatalities as well as disabling injuries, were around $242 billion. States that do need insurance conduct periodic arbitrary checks of motorists for proof of insurance deductible meaning insurance.

Insurance Agent Job Description Things To Know Before You Get This

If you drive without vehicle insurance coverage and also have an accident, penalties will possibly be the least of your financial concern. If you, a guest, or the various other chauffeur is hurt in the mishap, auto insurance coverage will certainly cover the expenses and also assist guard you versus any lawsuits that may result from the accident.Again, similar to all insurance coverage, your private scenarios will certainly determine the cost of automobile insurance coverage. To make certain you obtain the right insurance for you, compare several rate quotes and also the insurance coverage given, and also examine periodically to see if you get lower prices based upon your age, driving document, or the area where you live (insurance and investment).

Always check with your employer initially for offered coverage. If your company does not use the kind of insurance policy you want, acquire quotes from a number of insurance coverage carriers. Those who use coverage in several locations may provide some discount rates if you buy even more than one kind of insurance coverage. While insurance policy is costly, not having it might be much more pricey.

The Single Strategy To Use For Insurance Asia Awards

Insurance is like a life vest. It's a little bit of a nuisance when you don't need it, however when you do require it, you're greater than happy to have it. Without it, you could be one vehicle accident, health problem or home fire away from drowningnot in the sea, yet in the red.Report this wiki page